Smart Wealth Platform

Empowering wealth advisors through technology, insights, and trust

An AI-powered platform with data-driven insights that help wealth advisors streamline workflows, enhance client relationships, and drive long-term success.

Who is it for?

For wealth advisors, family offices — and the institutions behind them

Sofistic.AI empowers you with a digital-first platform that unifies client data across financial planning tools, CRM systems, and custodians — giving you one place to visualize, analyze, and act on your clients’ total wealth picture.

Wealth Advisors

Sofistic.AI centralizes information from your financial systems, CRM, and planning tools into one intuitive interface — giving you a complete view of your clients’ total wealth. Identify opportunities, deepen relationships, and guide decisions with clarity, efficiency, and added value.

Learn moreFamily Offices

Sofistic.AI replaces spreadsheets with a single, visual platform for total wealth management. Gain a 360° view of client portfolios — including private assets, businesses, insurance, and real estate — to deliver insights, optimize decisions, and provide peace of mind with simplicity and transparency.

Learn moreFinancial Institutions

Sofistic.AI centralizes client data across systems to deliver a full view of total wealth — including off-book assets. Empower advisors, gain firmwide intelligence, and drive revenue with visual dashboards and AI-driven insights.

Learn moreBenefits

Increase engagement, improve processes

The Sofistic.AI platform is designed to centralize all data in an AI-powered platform, allowing you to focus on what matters: your clients.

Platform Overview

Your end-to-end smart wealth management platform

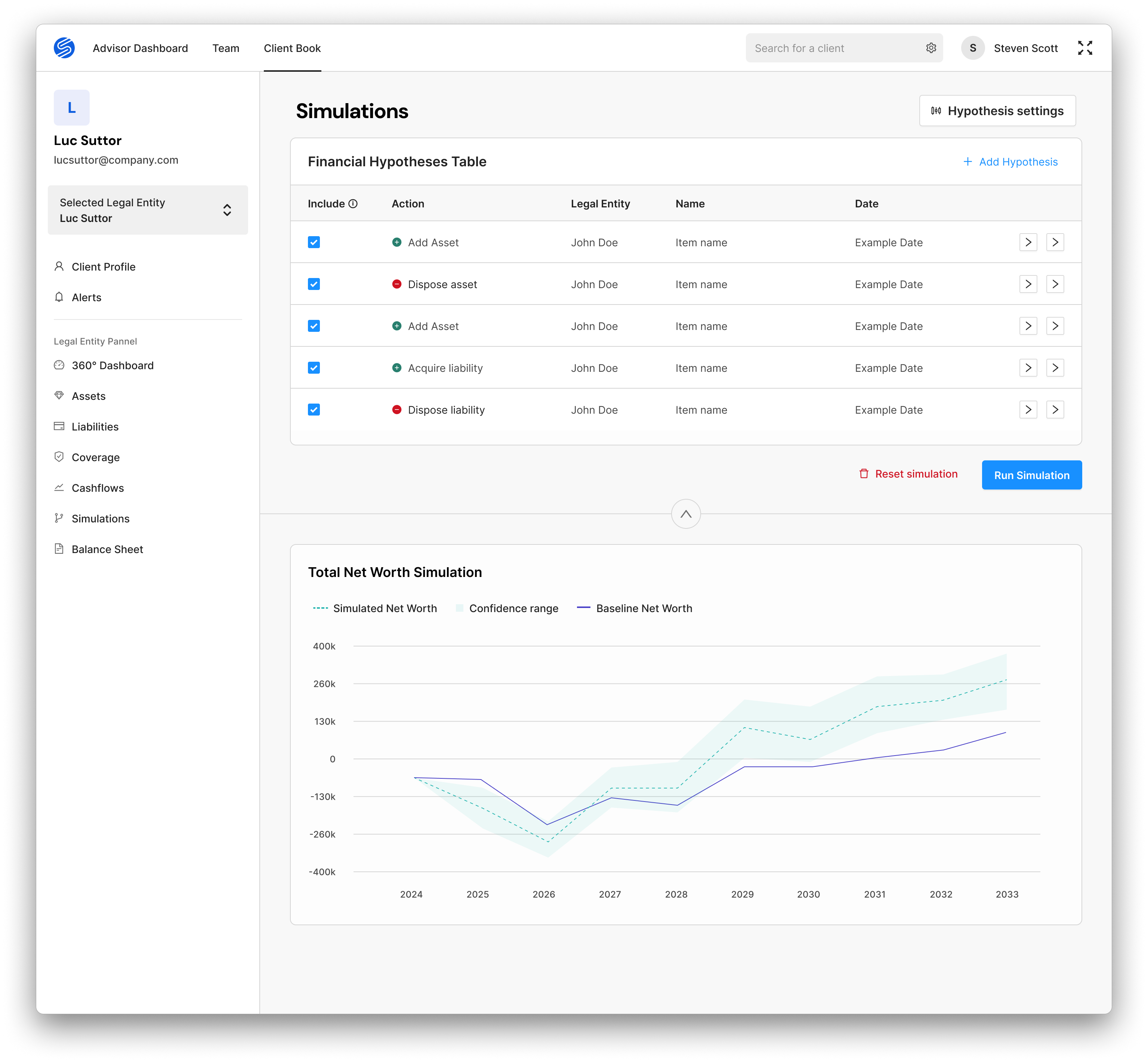

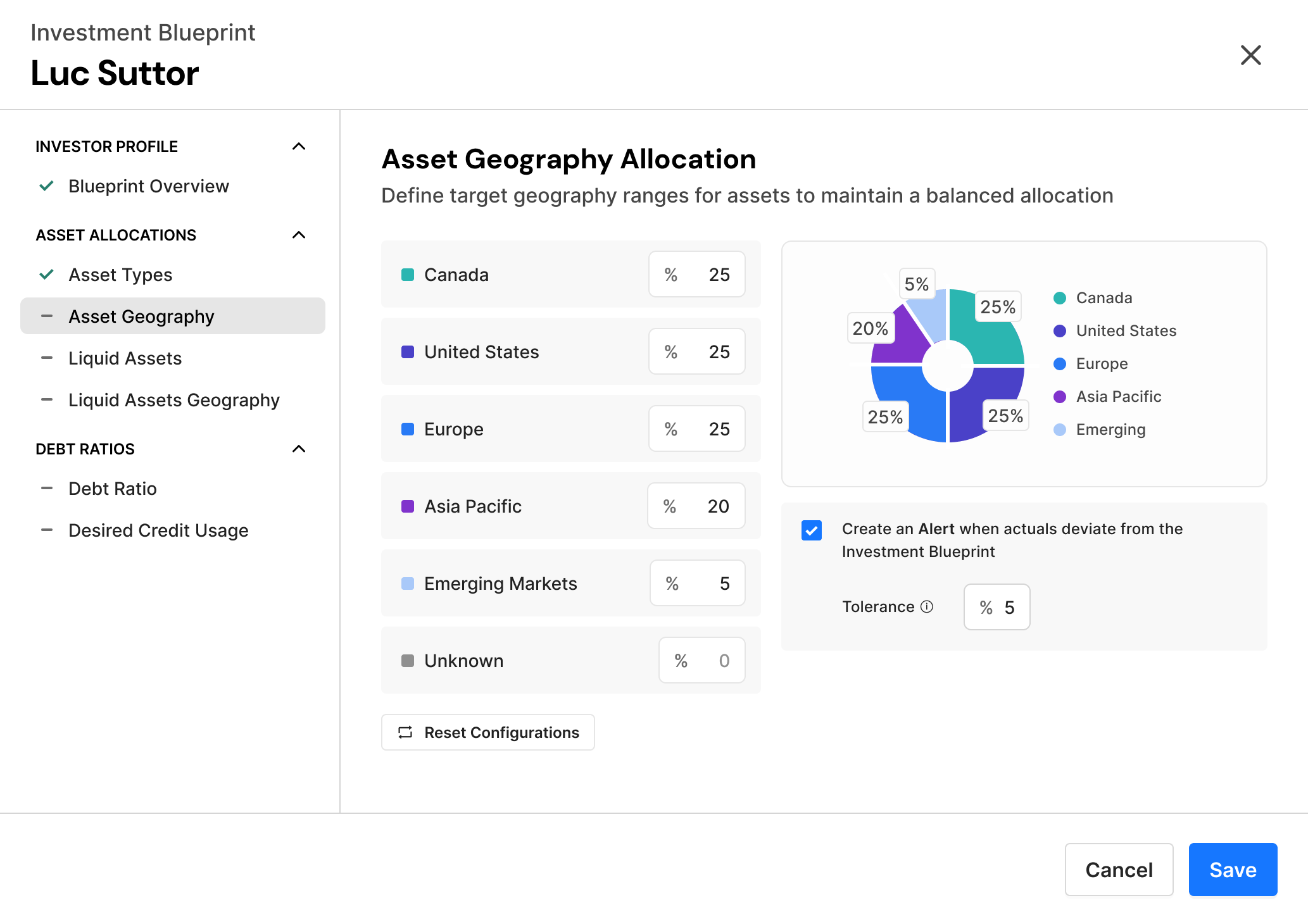

Our wealth management platform is designed to strengthen the relationship and trust between family offices or wealth advisors and their clients. Powered by dynamic cash flow projections, powerful investment simulations, smart notifications, advisors can confidently guide clients and foster meaningful discussions, allowing their clients to achieve lasting financial success.

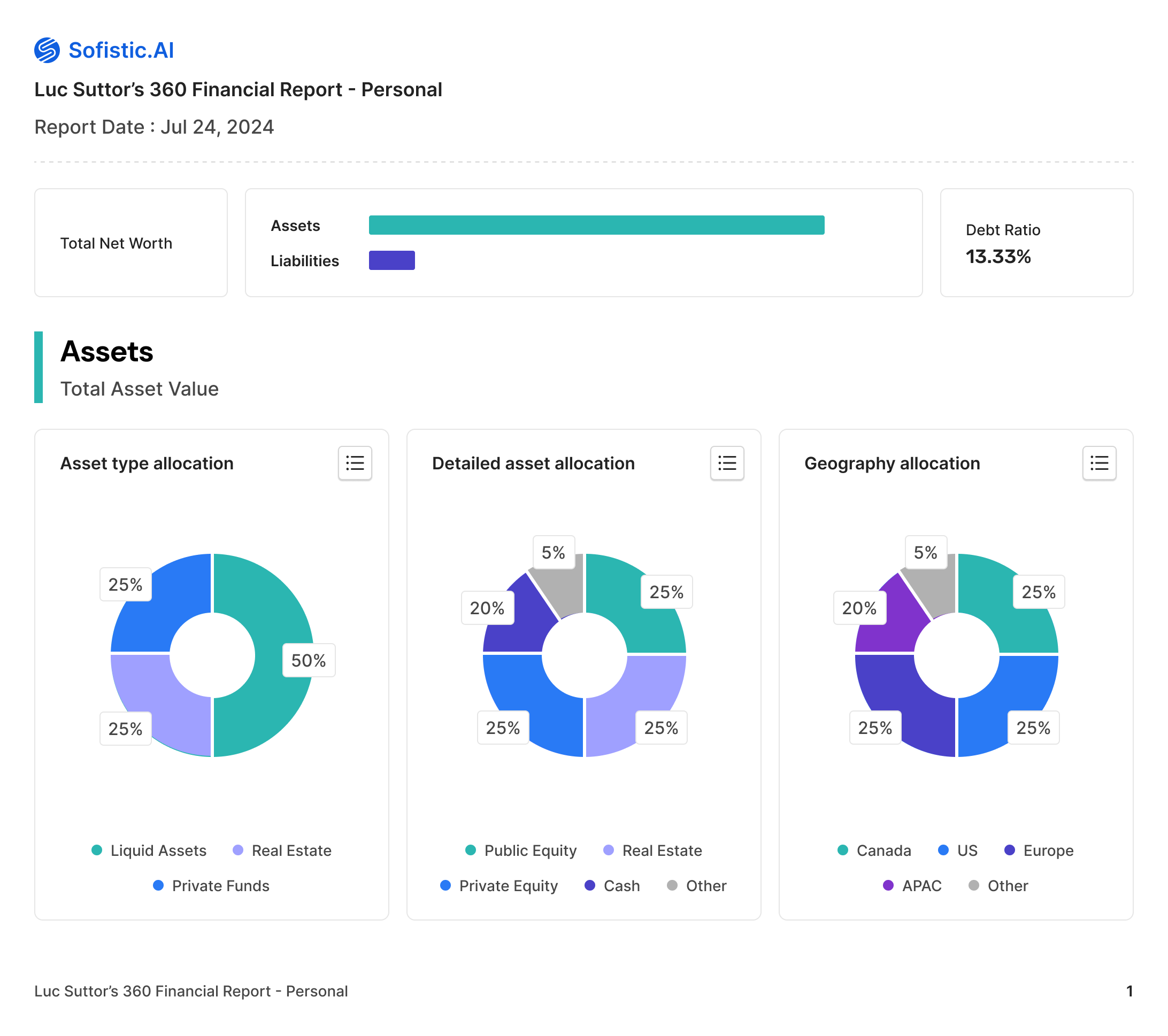

- 360° Consolidation

Comprehensive 360 dashboard providing insights on both sides of the balance sheet with dynamic insights and real-time updates

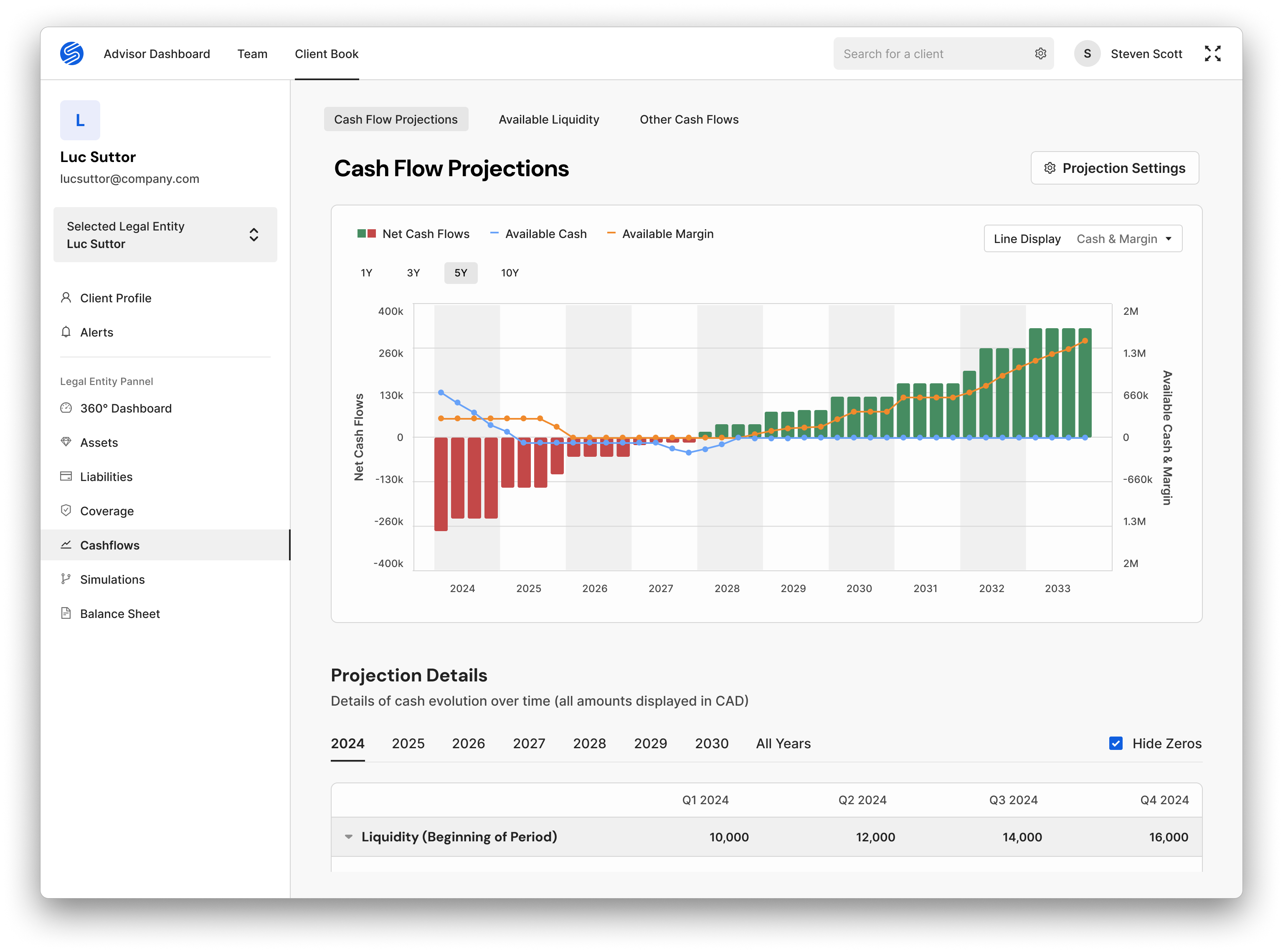

- Smart Forecasting

Forecasting that adapts to real-time data across assets, liabilities, coverage, and personal cash flows with scenario simulation

- Informed Decisions

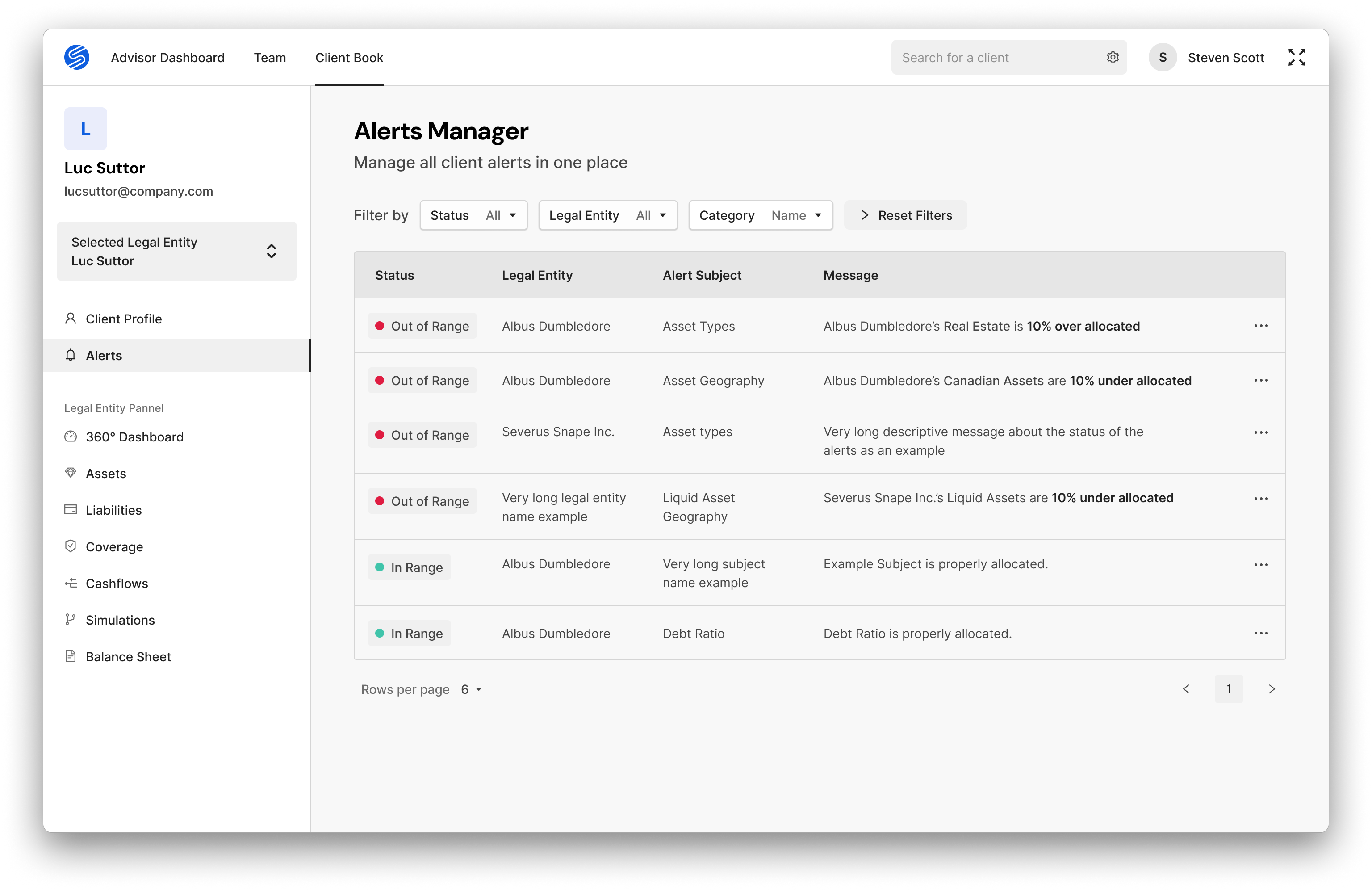

Harness the power of data to enhance automation, and decision-making for wealth management professionals

Key Features

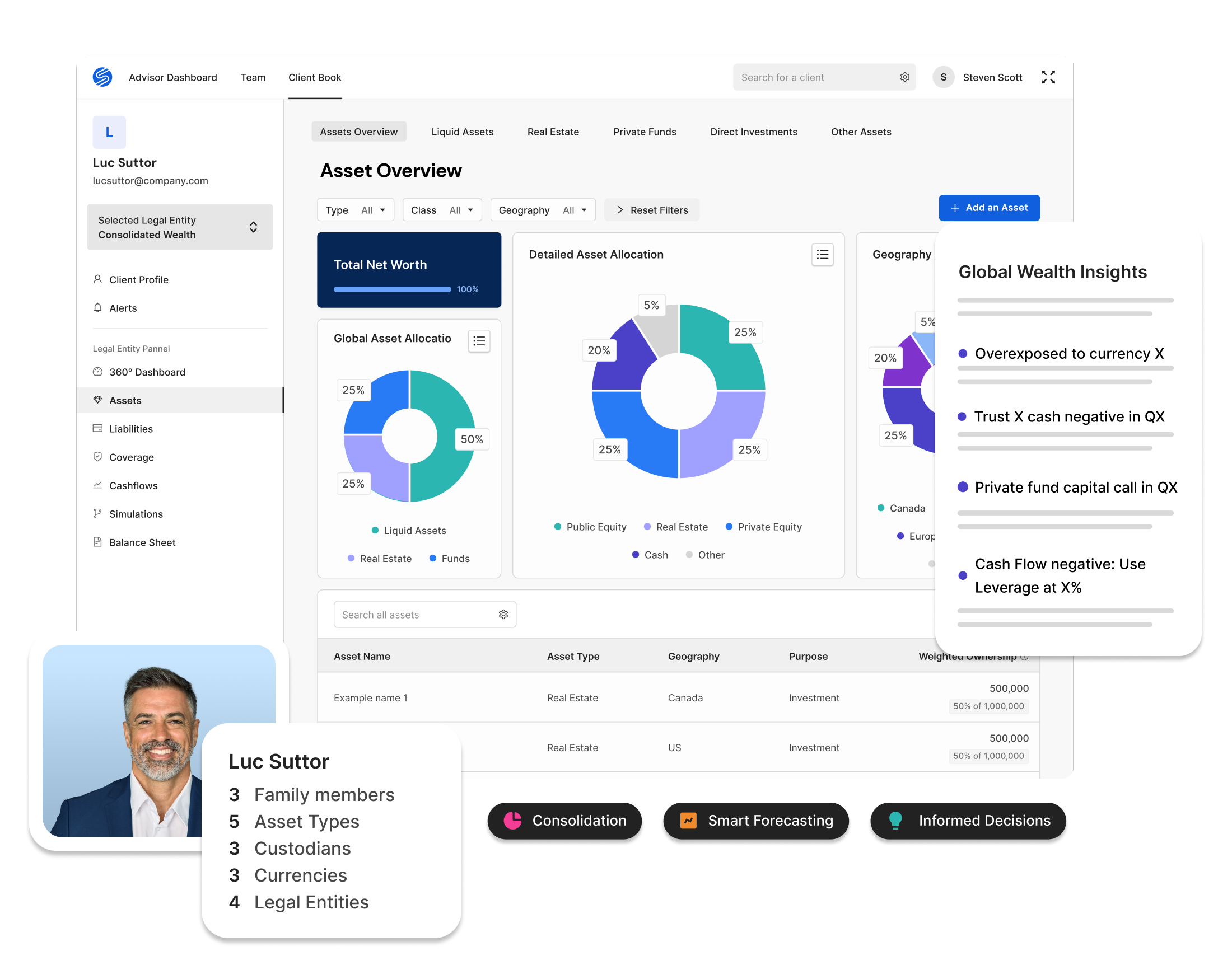

Unlock the full potential of wealth management

Explore powerful tools, smart insights, and dynamic dashboards designed to streamline wealth management and drive smarter, real-time decisions.